3 min read

| 11 October 2023

Rethinking the Digital Pathway: Should CPG Brands Drive Traffic to Their Own Website or Retail Partners?

Introduction

In the past, it made sense for Consumer Packaged Goods (CPG) manufacturers to drive traffic to their retail partners to spur sales. This was a time when brick-and-mortar stores were the prime, and sometimes sole, sales channel. This dynamic changed with the dawn of online shopping when many CPG brands began investing in digital direct-to-consumer (DTC) channels allowing them to directly capture an increasing share of sales1. The pandemic accelerated investment into DTC channels as consumers favored online shopping over going to physical stores2.

Even with DTC e-commerce channels of their own though, many CPG brands continue to channel the majority of their online traffic to retailer partner websites. This poses the question: Is this the best strategy? What does a CPG manufacturer gain, if anything, by driving digital traffic to their own brand.com site, even if they don’t have e-commerce capabilities on the site?

The Limitations of Relying on Retail Partners Alone

Purchased conducted a meta-analysis of 16 CPG studies it had recently conducted in six markets3 and in six categories4 to better understand the relative value of driving traffic to brand.com vs retailer.com. This meta-analysis looked at the following metrics:

- Consideration

- Click-through Rate

- Overall Purchase

- First-time Purchase

Results

Here's what we found with respect to brand metrics and sales:

- Consideration:

- Clicking through to a Brand.com website leads to +33 ppts lift in Consideration compared to clicking through to a retailer.com website.

- First-Time Purchase:

- Clicking through a Brand.com website leads to +10 ppts lift in First-time Purchase of the advertised brand compared to clicking through to a retailer.com website.

- Click-Through Rate

- Shoppers exposed to brand.com paid search ads click on those ads at a lower rate than when exposed to retailer.com ads - on average, 28% of shoppers clicked on the brand.com ad versus 36% of shoppers who clicked on the retailer.com ad.

At first glance the lower click through rates for brand.com paid search ads might lead an advertiser to maintain ad spend for driving traffic to retailer.com. The higher omnichannel conversion rates for brand.com lead to a different conclusion however.

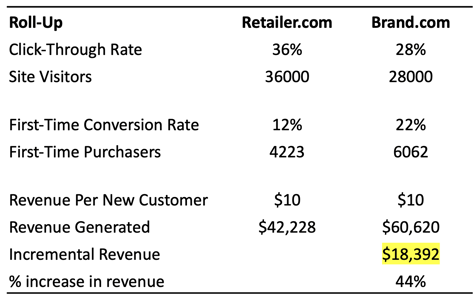

The Cost of Sidestepping Brand.com Traffic

Merely channeling shoppers towards retail affiliates isn't just about overlooking potential gains—it's a misstep that could cost you a significant chunk in returns. Let's visualize this scenario: two groups, each with 100,000 shoppers. One group encounters retailer.com's paid search ads, while the other brand.com's paid search ads. As mentioned above, retailer.com captures 36% of click-throughs with its ads and brand.com lags behind at 28%. However, the real twist is in the omnichannel conversion game: while only 12% from retailer.com take the buying leap of the advertised brand, brand.com boasts a robust 22% conversion. To determine the revenue impact, assume an average revenue of $10 for each new shopper. Retailer.com garners a respectable $42,228. But brand.com? It steals the limelight with a hefty $60,620. The bottom line? By redirecting traffic to brand.com could net an additional $18,392 for the same 100,000 shoppers in our example, an additional 44% of revenue.

Conclusion & Next Steps

Understanding the omnichannel value of directing traffic to a brand.com site versus a retailer.com is crucial for your marketing strategy. While there's undeniable value in partnering with retailers, the data suggests that CPG brands can reap substantial benefits by driving traffic to their own sites. It's not just about direct sales but building a deeper connection with consumers. After all, in a competitive digital landscape, those brands that can successfully leverage their own platforms stand a chance to foster loyalty and maximize ROI in ways previously unimagined.

We can help you quantify the value derived from each approach, enabling you to make informed investment decisions. Interested in learning more about how we can help you evaluate your web traffic strategy?

1 Online net sales have accelerated strongly on a global basis, reflecting strong double digit growth for fiscal 2020, as well as growth in all product categories and from nearly every brand. We continue to enhance and launch e- and m-commerce sites of our own in new and existing markets…” Source: Estee Lauder 2020 Annual Report.

2 Beyond Meat, Bimbo, Del Monte and PepsiCo/Frito Lay all launched DtC websites during the pandemic

3 US, UK, FR, MX, CA, AU

4 Dog Food, Skin Care, Grocery, Pain Relief, Beauty